Data leaders face a high-stakes challenge as stricter global and state-level privacy laws, like the American Privacy Rights Act (APRA), ramp up financial penalties — potentially up to 4% of a company’s global revenue — for compliance failures. Organizations must prepare for increased accountability and standardization in data privacy, sovereignty, and ethical AI governance, all of which demand stronger data safeguards and transparent practices. Breaking down internal data silos and embedding proactive privacy measures such as Privacy by Design (PbD) will become critical steps toward compliance. To future-proof their strategies, data leaders should adopt upstream data contracts, automated data lineage processes, and comprehensive staff training.

Citigroup’s $81 trillion “Fat Finger” error – operational risk warning

Citigroup revealed a jaw-dropping data mishap: an employee erroneously credited a customer’s account with $81 trillion instead of $280, a mistake caught and reversed within hours. Regulators were notified of this “near miss,” which underscored Citi’s ongoing operational and data management issues. Citi’s CFO acknowledged the bank must invest more in data quality and regulatory reporting controls after such errors.

The role of data has changed

The role of data has changed in the last few years and the amount of data that organizations are dealing with has grown exponentially. The amount of data is staggering, but the role of where data fits into your testing process and initiatives is even more important. Whether your organization is dealing with migrations, AI/ML initiatives, or compliance requirements – the health of your data is going to affect the outcomes of all of these projects. If the health of your data is poor, the risk is too high to allow it to be used to make business decisions.

Bad data is expensive

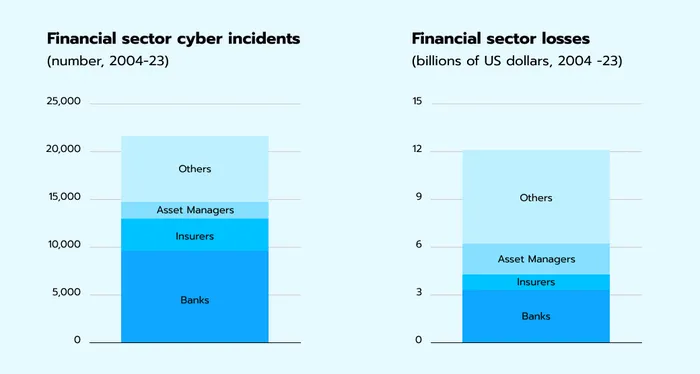

According to the 2024 Global Financial Stability Report, produced by the International Monetary Fund (IMF), over the past two decades, the financial sector has experienced over 20,000 cyberattacks, resulting in a staggering $12 billion loss (see Fig. 1).

Credit: DORA and beyond: what do new compliance standards mean for banking and finance?

based on graphic from Rising Cyber Threats Pose Serious Concerns for Financial Stability

Closing the compliance gap with data you can trust

Tricentis Data Integrity is a unique data testing solution that’s end-to-end, automated, and continuous — enabling you to make sure your analytical and operational data arrives intact and fit for purpose wherever its destination. It’s the only solution that enables you to test data, UI, and API layers regardless of data type, source, or format — across your application and analytics ecosystems. A great addition to your data toolkit, it enables you to bring the discipline of end-to-end testing to the world of data filling data management gaps and driving better business outcomes. Ready to learn more? Watch our product tour.